RACING AUSTRALIA ANNUAL REPORT 2016

| 77

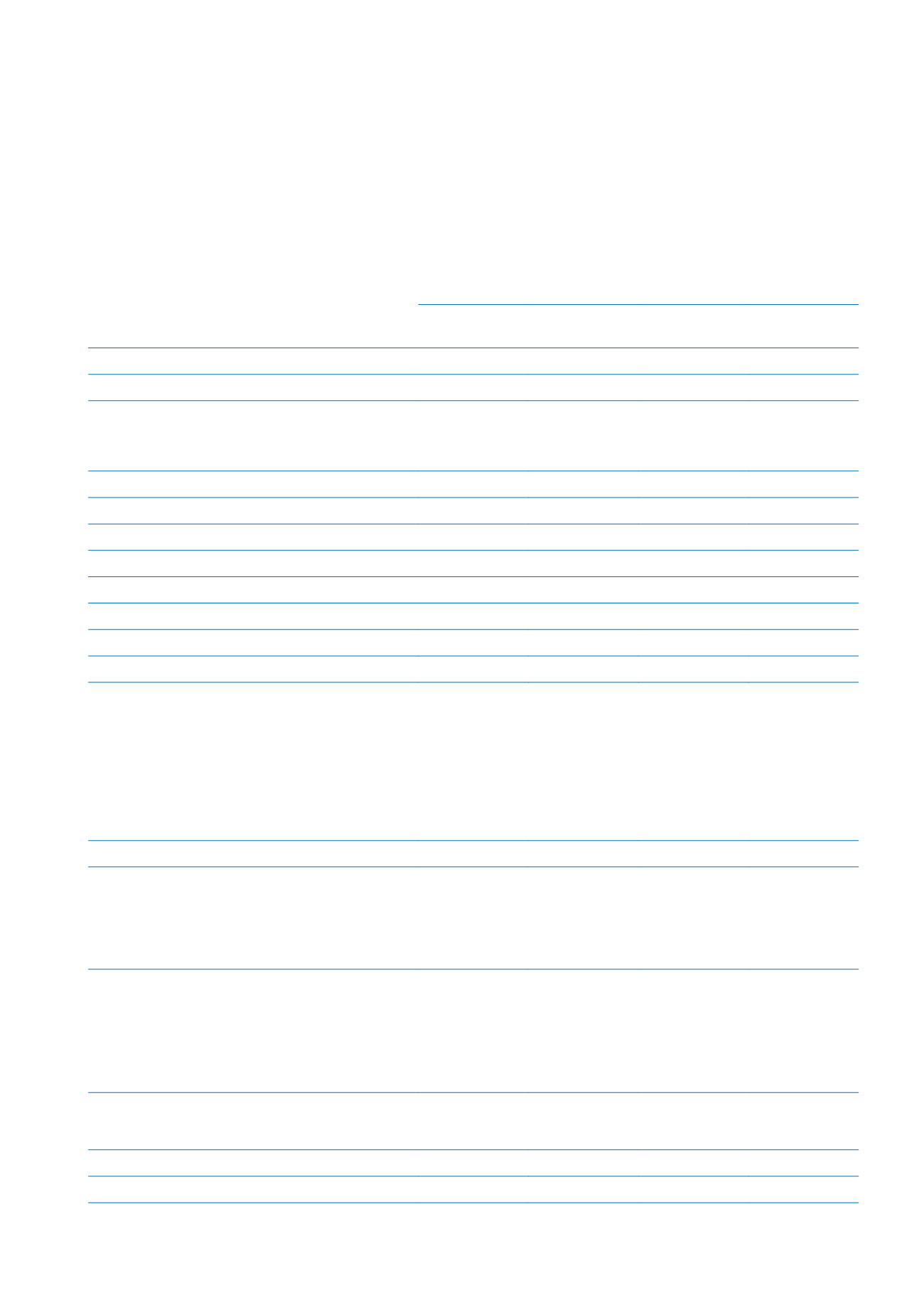

Consolidated entity

Parent entity

2016

$

2015

$

2016

$

2015

$

NOTE 11: ISSUED CAPITAL

Fully paid ordinary shares

10,103,051

10,103,051

10,103,051

10,103,051

Fully paid ordinary shares

Racing NSW

3,536,068 3,536,068 3,536,068 3,536,068

Racing Victoria Limited

3,536,068 3,536,068 3,536,068 3,536,068

Racing Queensland

1,818,548

1,818,548

1,818,548

1,818,548

Racing and Wagering Western Australia

454,637

454,637

454,637

454,637

Thoroughbred Racing SA Limited

454,637

454,637

454,637

454,637

Thoroughbred Racing NT Incorporated

101,031

101,031

101,031

101,031

Tasracing Pty Ltd

101,031

101,031

101,031

101,031

Canberra Racing Club Incorporated

101,031

101,031

101,031

101,031

10,103,051

10,103,051

10,103,051

10,103,051

The Company was incorporated on 20 August 2003. An issue of 200 ordinary shares has been made. The

Company's name at the date of incorporation was Racing Information Services Australia Pty Ltd. The Company

changed its name to Racing Australia Pty Ltd on 14 April 2015. On 18 September 2015, Racing Australia Pty Ltd

converted to an unlisted public company limited by shares, Racing Australia Limited. The Company is an unlisted

company limited by shares.

Fully paid ordinary shares carry voting rights but no rights to dividends.

NOTE 12: SHARE CAPITAL

Investment in AGT

-

-

2

2

The Company invested in Australian Genetics Testing Pty Ltd on 17 September 2014 as part of the Australian

Stud Book asset purchase. On purchase of the Australian Stud Book, Racing Australia also purchased 2 fully paid

ordinary shares in Australian Genetics Testing Pty Ltd.

NOTE 13: INVESTMENT

Investment in Australian Genetics Testing Pty Ltd is recognised and derecognised on trade date where the purchase

or sale of an investment is under a contract whose terms require delivery of the investment within the timeframe

established by the market concerned, and are initially measured at fair value, net of transaction costs except for

those financial assets classified as at fair value through profit or loss which are initially measured at fair value.

NOTE 14: KEY MANAGEMENT PERSONNEL COMPENSATION

The totals of remuneration paid to KMP of the

company during the year are as follows:

KMP Compensation

1,071,597

612,175

1,071,597

612,175

1,071,597

612,175 1,071,597

612,175

Racing Australia Limited

| ACN 105 994 330 and Controlled Entities | Annual Report for the Financial Year Ended 30 June 2016